On the fateful day of February 6, a calamity unlike any other unfurled within the cryptic corridors of the crypto market. Bitcoin, that once-mighty titan of digital currency, plummeted like a lead balloon, nosediving nearly 15% and erasing a staggering $350 billion from existence, all in the blink of an eye. The price now sits at a mere $60,030, as if mocking the grand peaks it once reached with its October frolic near $126,000.

Gone are the days of the “Trump bump” rally from November 2024; like a magician’s vanishing act, it has dissipated amid a frenzy of selling pressure-miners fleeing, profits being pocketed, and global jitters spreading like gossip at a village well.

Bitcoin’s Demise: Miners in a Dilemma

The root of our sad tale lies with the beleaguered Bitcoin miners. The cost of extracting one shiny Bitcoin has risen above $87,000-an amount that would make even the most extravagant of budgeters weep. With Bitcoin trading around $65,000, these miners are caught between a rock and a hard place, forced to sell their digital treasures just to keep the lights on.

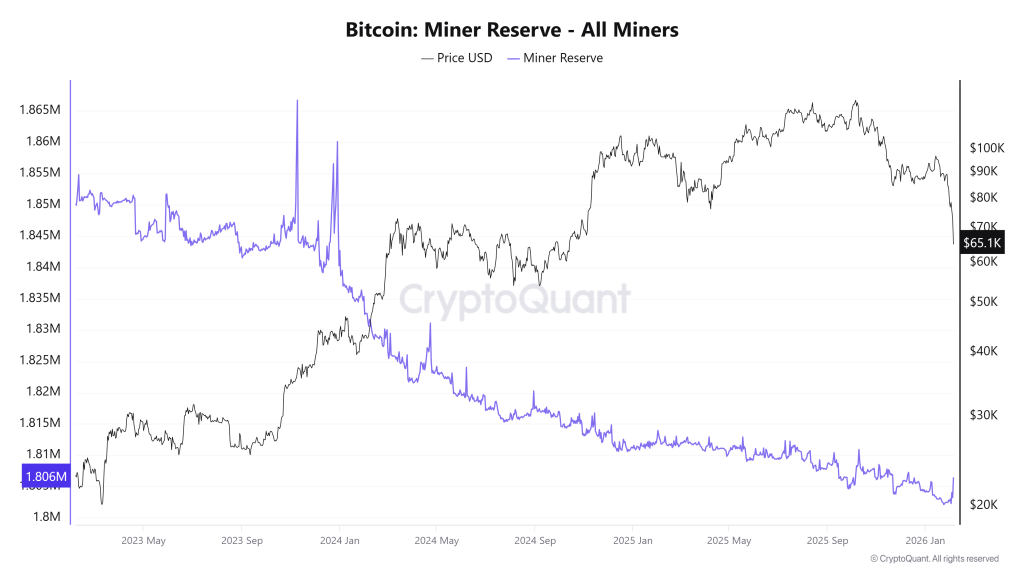

As the months rolled by, Bitcoin miner reserves have dwindled to a shocking 1.806 million BTC. It appears our miners are not just mining but also shedding coins faster than a dog sheds fur in spring.

ETFs: A Great Exodus

Meanwhile, the institutional crowd is pulling their proverbial socks up and running for the hills. Bitcoin exchange-traded funds (ETFs) are witnessing heavy outflows, with a net withdrawal of $258.8 million recorded just yesterday. While this is a marked improvement from the previous day’s $544.9 million exodus, the week’s total has already crossed the ominous threshold of $1.07 billion. One wonders, do they see a storm brewing?

Liquidations: The Icing on the Cake

Ah, liquidations! The delightful cherry atop this financial catastrophe cake! In a mere 24 hours, over $2.65 billion worth of leveraged crypto positions met their untimely demise. The majority of those liquidations, approximately 82%, were from long traders who were betting on prices doing the cha-cha rather than the limbo.

The largest liquidation was a doozy, occurring on Binance, where a BTCUSDT position worth $12 million was closed with all the grace of a clumsy ballerina.

Saylor’s Sorrowful Strategy

Even the titans of industry are feeling the pinch. Michael Saylor’s Strategy reported an unrealized loss of about $9 billion, which equates to a hefty 16% of its colossal Bitcoin stash. Yet, like a good shepherd, Saylor urges investors to remain calm and “HODL”-a word that seems more like a mantra for masochists than a sound strategy.

HODL

– Michael Saylor (@saylor) February 5, 2026

In a moment of unexpected wisdom, Ripple CEO Brad Garlinghouse echoed the sage advice of Warren Buffett: be fearful when others are greedy and greedy when others are fearful. Wise words indeed, albeit delivered while the ship is sinking.

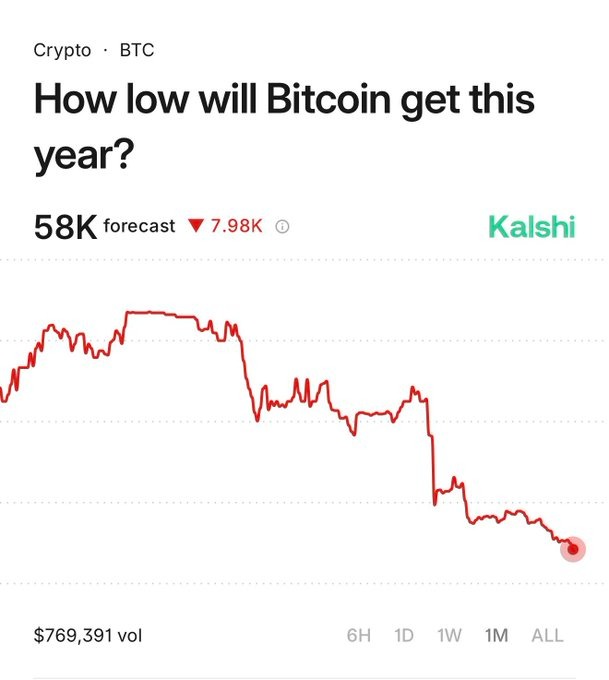

The Price Outlook: A Gloomy Forecast

Bitcoin now stands at a precipice, testing one of its most crucial support levels in recent memory. Should it fail to cling to the $60,000 mark, analysts predict a darkened path ahead, with the specter of $58,000 looming in 2026. Traders over at Kalshi seem to agree, perhaps flipping a coin or two in their predictions.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- New Naruto Anime Is Officially Coming In 2026

2026-02-06 07:46