Traders Dance on Precipice of Chaos as Bitcoin Falters and Oil Roars

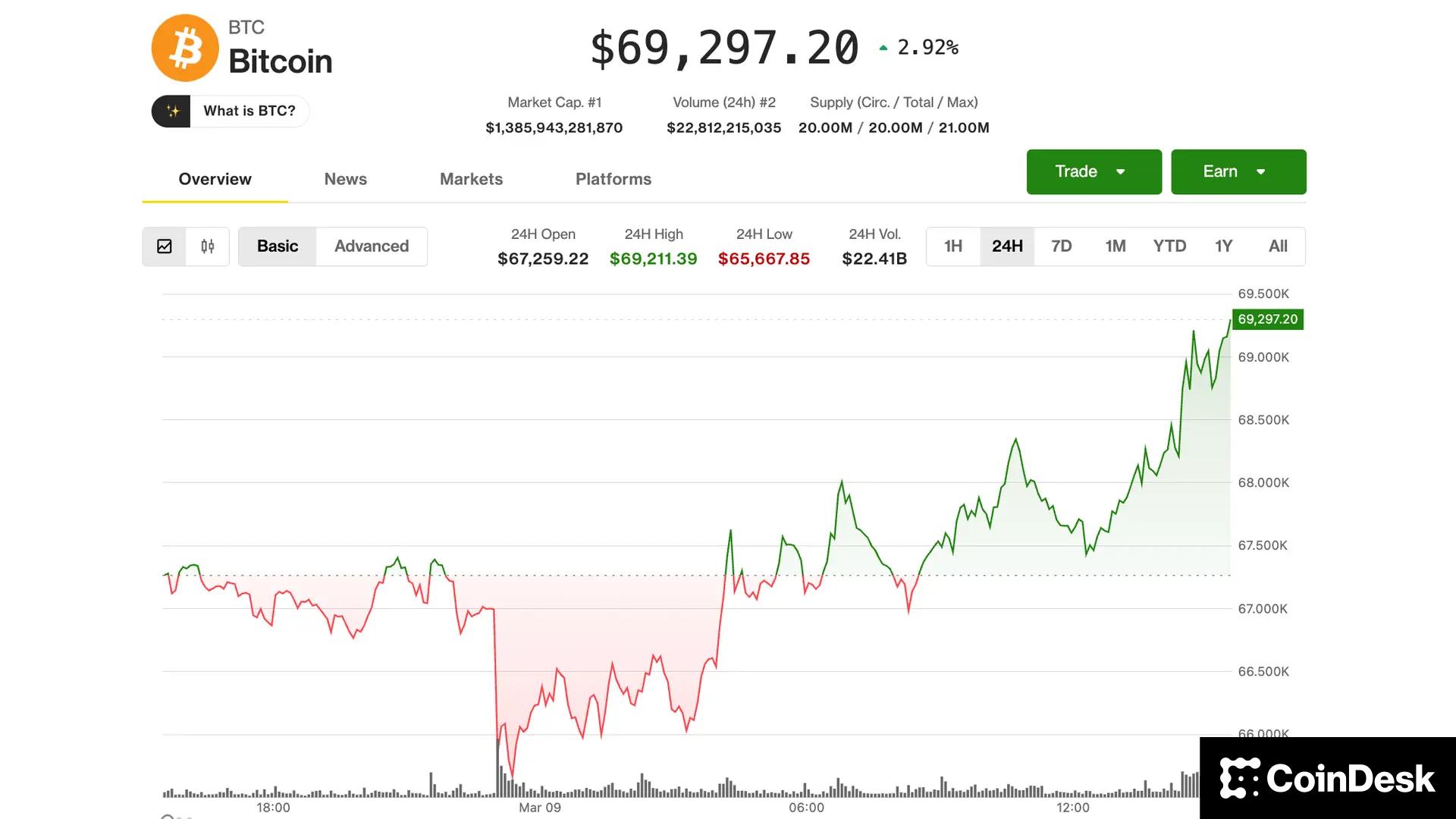

The so-called “land of the free” trembles as Iran’s shadow looms, sending crude prices into a frenzy usually reserved for revolutionary uprisings. Yet Bitcoin, that digital messiah once hailed as humanity’s great hedge against chaos, slinks away like a chastened dog-down 2.4% to $65.6k, its lowest in a week. How poetic: the asset meant to defy tyranny now cowers before the specter of geopolitics.