Bitcoin Traders Hit the Brakes: Leverage Takes a Coffee Break!

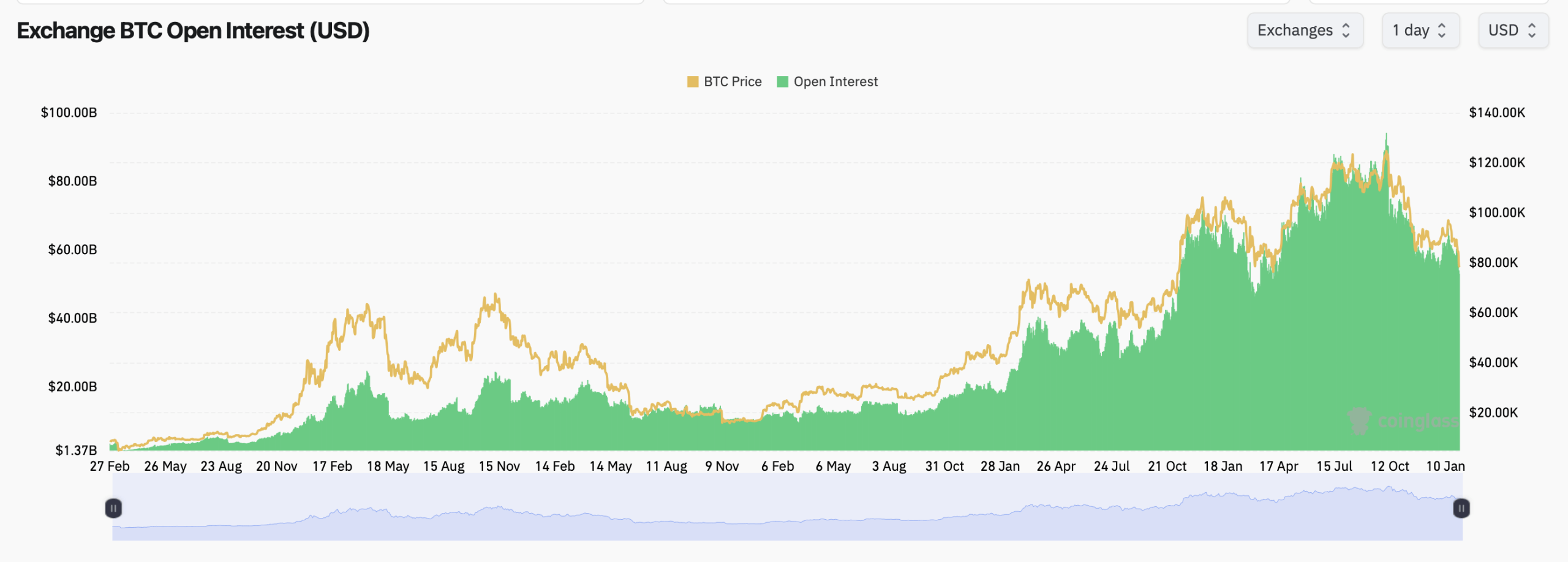

Across the wild west of derivatives exchanges, bitcoin futures open interest is sitting at 677,730 BTC, or a whopping $52.98 billion. But hold onto your hats-that’s a 6.83% drop in the last 24 hours! Looks like January’s volatility left everyone with a hangover.