As a seasoned crypto investor with over a decade of experience navigating the digital asset market, I’ve witnessed the SEC’s evolution from a casual observer. The recent surge in fines against crypto firms, spearheaded by Terraform Labs, represents a seismic shift in the regulatory landscape that is long overdue.

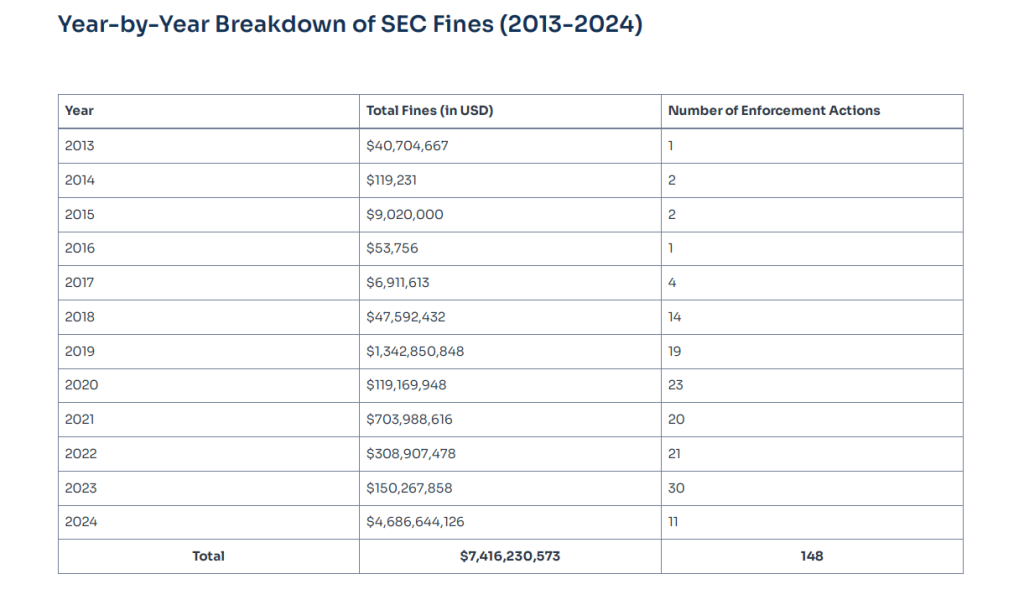

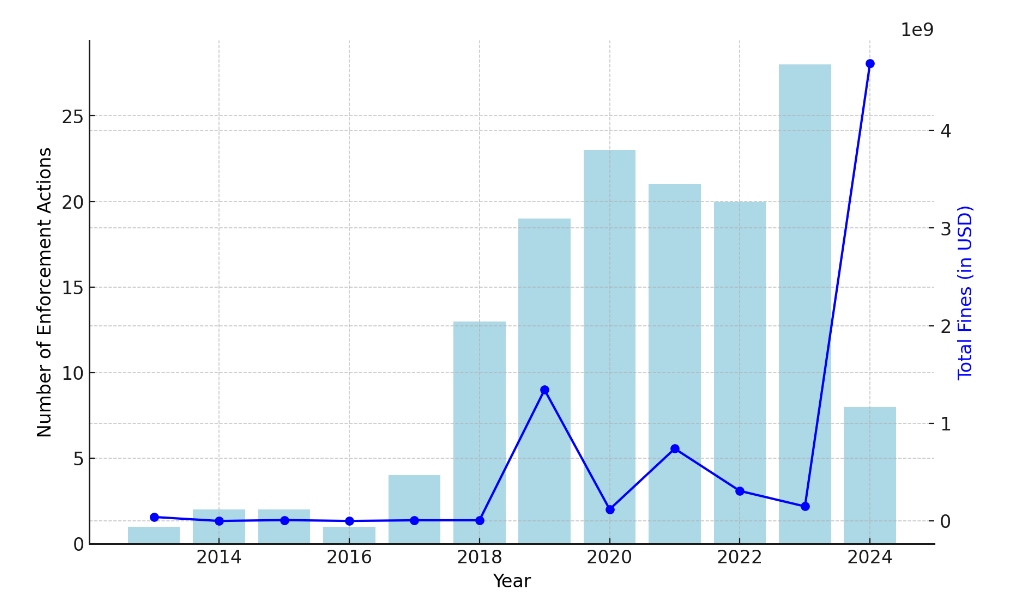

The U.S. Securities and Exchange Commission (SEC) has been making headlines due to its unprecedented enforcement actions against the cryptocurrency industry: The fines imposed on crypto companies skyrocketed to an all-time high of $4.68 billion in 2024, marking a staggering 3,018% increase compared to the previous year.

A significant portion of the increase is attributed to a resolution with Terraform Labs and its co-creator, Do Kwon, over allegations of selling unlicensed securities and misleading investors.

Based on the Enforcement vs Crypto Industry Report 2024 by Social Capital Markets, the recent moves made by the SEC suggest a significant change in their enforcement strategy towards the rapidly evolving digital assets sector.

Record-Breaking Fines

63% of all fines imposed by the Securities and Exchange Commission (SEC) between 2024 and now account for a total of $7.42 billion, bringing the overall sum to this figure since 2013. The SEC’s tough approach is clearly demonstrated in its ongoing enforcement efforts, which have seen penalties climb significantly since 2018 when they first surpassed ten digits.

As a researcher in 2023, I’ve noticed an intriguing change: the Securities and Exchange Commission (SEC) levied fines amounting to just $150.27 million. This is strikingly different from the monumental penalties we’ve seen this year, which set new records. This shift seems to suggest a renewed dedication on their part to ensure that cryptocurrency firms are held responsible for their actions.

To this day, the approximately 4.7 billion dollar penalty assessed towards Terraform Labs stands as the largest ever levied against a cryptocurrency firm.

In this instance, it surpassed the prior record – a roughly $4.3 billion settlement between the U.S. Justice Department and Binance, together with its founder, which took place in 2023. The Securities and Exchange Commission’s actions are not standalone events; they align with a growing pattern of intensifying surveillance and regulation within the cryptocurrency sector.

The Evolving Strategy Of The SEC

Over the last ten years, the approach of the Securities and Exchange Commission (SEC) towards enforcement has undergone substantial changes. At first, monetary penalties tended to be rather small, but with the expansion of the cryptocurrency market, these fines have grown substantially.

In the year 2019, the SEC levied a fine worth $1.24 billion against Telegram due to them conducting an unauthorized token sale. Similarly, Ripple Labs were fined $125 million in 2021 for selling XRP as an unregistered security, reflecting an increasing trend of substantial penalties.

The Road Ahead

The increased regulatory action by the SEC is causing ripples throughout the cryptocurrency sector. In fact, many companies such as Coinbase and Ripple are currently embroiled in legal disputes with this governing body.

According to SEC Chairman Gary Gensler’s perspective, a majority of digital assets are subject to securities regulations, sparking heated debates about the future trajectory of cryptocurrency within the United States.

Some critics argue that the Securities and Exchange Commission’s actions are driving crypto firms overseas, thereby hindering technological advancements in this field. On the other hand, supporters of the SEC believe that strict regulations are essential for protecting investors and maintaining the honesty of financial markets.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- USD PHP PREDICTION

- TON PREDICTION. TON cryptocurrency

- USD ZAR PREDICTION

- Top gainers and losers

- ENA PREDICTION. ENA cryptocurrency

- EUR USD PREDICTION

2024-09-10 14:11