As a seasoned analyst with a knack for deciphering market trends and a keen interest in the crypto sphere, I find it intriguing to observe the recent surge in investment activity within the digital asset space. The latest Coinshares report, which shows a whopping $533 million inflow into digital asset investment products in just one week, is a testament to the growing acceptance and maturity of cryptocurrencies as a viable investment option.

Last week saw a notable surge in crypto investment, as per the recent findings from Coinshares. This surge represented the largest influx of investments into digital asset products in the past five weeks.

The increase is due to investors expecting possible reductions in interest rates from the U.S. Federal Reserve, a move that may significantly influence various financial sectors such as the stock market and digital currencies like Bitcoin.

Dissecting The Crypto Asset Fund Flows: Bitcoin Leads The Charge

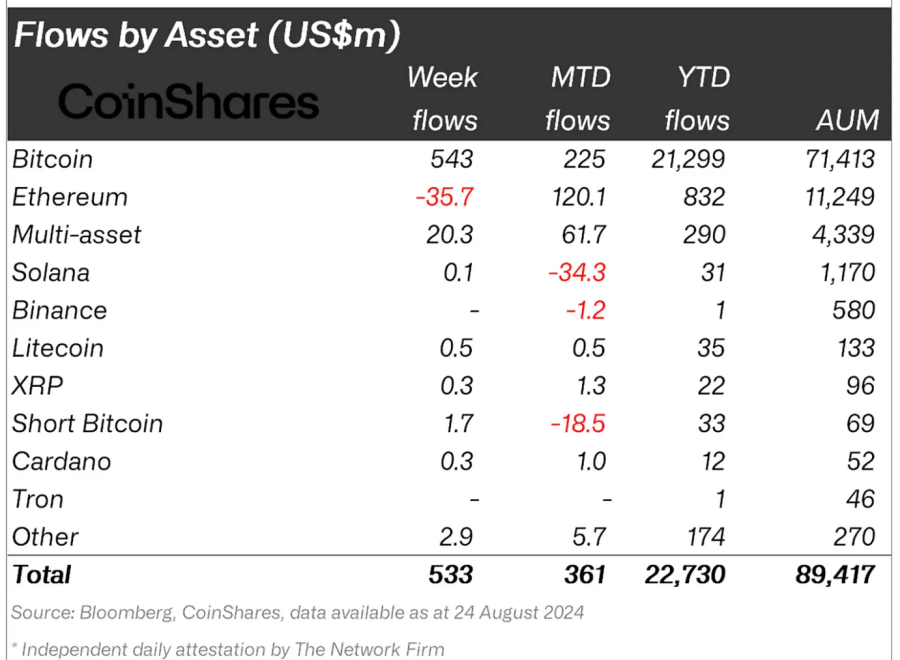

Based on a recent report by CoinShares, digital asset investment products experienced inflows worth approximately $533 million during the week of August 18 to August 24. This significant increase suggests a change in investor sentiment towards the market.

A significant portion of these inflows, approximately $543 million, was channeled into Bitcoin-focused exchange-traded products (ETPs).

The report revealed that the surge in Bitcoin investment activity happened around the same time as when Federal Reserve Chair Jerome Powell spoke at the Jackson Hole Symposium on August 21.

According to Powell’s suggestion, the initial reduction in interest rates might take place as soon as September 2024, leading investors to adjust their investment strategies in preparation for what could be a more advantageous climate for riskier assets such as cryptocurrencies.

As reported by CoinShares, it was Bitcoin that primarily attracted renewed investor attention, with a significant portion of investments flowing into Bitcoin-linked Exchange Traded Products (ETPs). The BlackRock iShares Bitcoin Trust (IBIT) was at the forefront, registering inflows totaling $318 million during the week.

CoinShares noted in the report:

It’s worth noting that most of the Bitcoin inflows occurred on Friday, likely spurred by the dovish remarks made by Jerome Powell, suggesting a correlation between Bitcoin’s price movements and anticipation towards interest rates.

Ethereum Performance In The Fund Flows

Conversely, Ethereum investment products experienced a downturn during that timeframe. Although more issuers of Ethereum ETFs managed to secure investments, there was a total withdrawal of $36 million from Ethereum-linked financial products.

As a crypto investor, I’ve noticed that the Grayscale Ethereum Trust (ETHE) played a significant role in the recent trend. Instead of the usual inflows, there were outflows totaling a substantial $118 million. This contrasts with the inflows that are typically seen in newer Ethereum ETFs.

Despite the outflows since their launch on July 23, Ethereum ETFs have amassed a total of $3.1 billion in investments. However, this growth has been somewhat offset by the withdrawal of $2.5 billion from Grayscale’s ETHE.

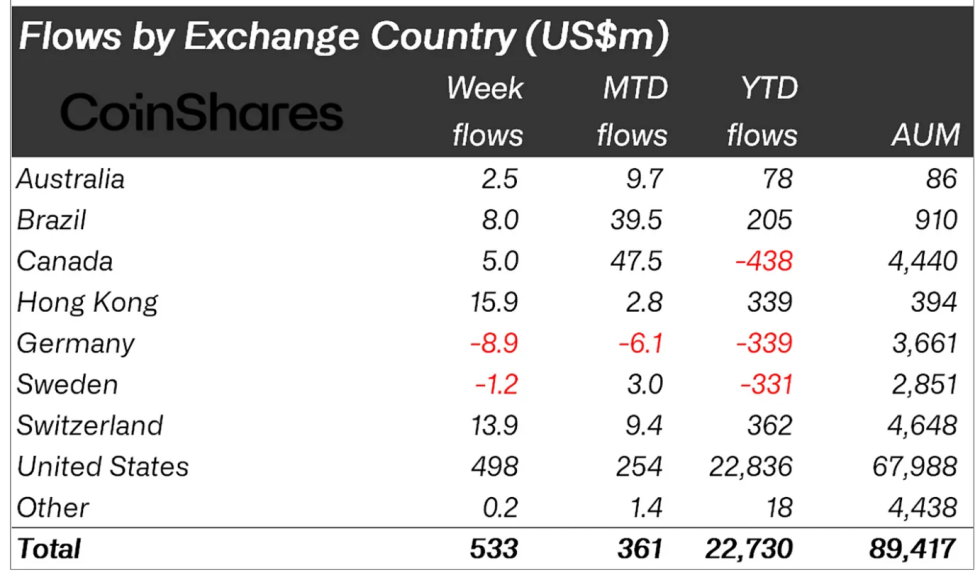

According to the CoinShares report, it was pointed out that there are regional disparities when it comes to investment flows. The United States is at the forefront of these investments, having received a significant amount of $498 million. Additionally, noteworthy inflows were observed in regions like Hong Kong and Switzerland, with amounts of $16 million and $14 million respectively.

Instead, Germany saw relatively small outward transfers totaling around $9 million, which places it among a limited number of nations that had net outflows during the year.

Featured image created with DALL-E, Chart from TradingView

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- USD PHP PREDICTION

- TON PREDICTION. TON cryptocurrency

- USD ZAR PREDICTION

- Top gainers and losers

- ENA PREDICTION. ENA cryptocurrency

- EUR USD PREDICTION

2024-08-27 02:12