So, it turns out that the Bitcoin whales and sharks—yes, those mighty crypto creatures that rule the ocean of digital currency—have been busy in the past few weeks. According to the crypto analytics platform Santiment (which sounds way more official than it probably is), these hungry crypto beasts have gobbled up a staggering $7.89 billion in Bitcoin over the past six weeks. Who knew digital coins could be this appetizing?

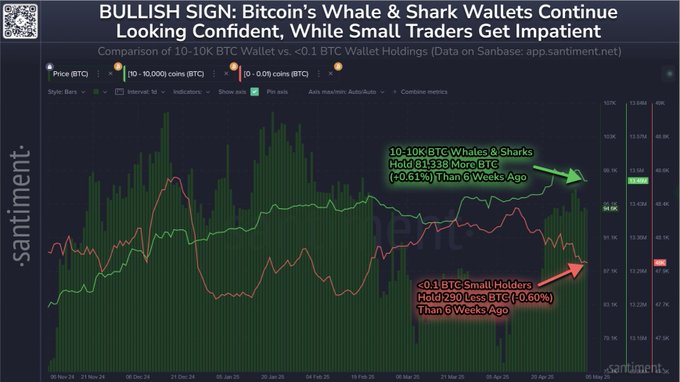

The platform reports that these whales and sharks—those holding anywhere from 10 to 10,000 BTC—have added a combined 81,338 more BTC to their underwater treasure chests. That’s not just a few spare coins lying around; that’s a real snack. 🍔

“As May progresses, Bitcoin’s key stakeholders are mostly moving in the right direction if you’re rooting for $100,000 BTC in the near future.” Well, isn’t that just peachy? Just when you thought Bitcoin might be taking a nap, these crypto giants are stirring the pot and probably dreaming of that sweet $100,000 price tag.

“Wallets with the highest correlation with crypto’s overall market health (10 – 10,000 BTC wallets) have accumulated a combined 81,338 more BTC (+0.61% of their holdings) during these past six weeks of volatility.” Volatility? More like a buffet for the big fish, am I right? The little guys are probably watching from the sidelines, wondering where their invites went.

Now, Santiment claims this kind of behavior is actually a bullish signal. That’s right—when the big players start hoarding, and the retail folks panic-sell because they’ve got better things to do (or maybe because they’re bored), it usually means a breakout is coming. Who’s ready for the next big surge? 🚀

“When large wallets gradually accumulate in tandem with retail panic selling/selling out of boredom, it is generally a strong long-term sign of prices biding their time before another breakout.” If you’re not sure what this means, it’s crypto-speak for “sit tight, the roller coaster is about to go up again.” 🎢

Meanwhile, the small wallets—those with less than 0.1 BTC—have been offloading their little piles of Bitcoin like they’re cleaning out their closets. In fact, they’ve dumped 290 BTC in the last six weeks. Maybe they needed space for the next shiny thing? Who knows. 📉

But wait, there’s more—Bitcoin exchange-traded funds (ETFs) have been riding a massive wave of inflows. Since mid-April, a jaw-dropping $5.13 billion has flowed into these ETFs. It’s like the market’s been hit by a flood of crypto-enthusiasm. Santiment notes:

“Bitcoin ETF inflow money has been sky-high since mid-April. Since April 16th, there has been $5.13 billion moved into collective BTC ETFs, pumping markets.” So, while you’re wondering where all the action is, it turns out there’s a whole lot of cash making its way into the market. 💸

And for the cherry on top, Bitcoin is trading at a cool $97,010 as of this moment. So, if you were thinking of getting into Bitcoin, you might want to grab your surfboard and catch that wave—before it crashes into $100k!

Read More

- Invincible’s Strongest Female Characters

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Reach 80,000M in Dead Rails

- Gold Rate Forecast

- USD ILS PREDICTION

- Silver Rate Forecast

2025-05-08 23:30