On a day when the sun mournfully stretched its tired rays above the steely towers of finance, a peculiar calm descended upon the world of high speculation. Ah, to witness a day without outflows—as if the mighty rivers of capital conspired to rest, just for once! It is said the crows outside BlackRock’s window sat still, awaiting a sign, but none came. Instead, all eyes turned to Bitcoin, that enigmatic traveler, as it sauntered past the threshold of $100,000, rather like a provincial gentleman mistakenly admitted to a royal ball, only to start dancing a lively mazurka. 💃

BlackRock & Fidelity: Duel at Dawn, with $117 Million Between Them

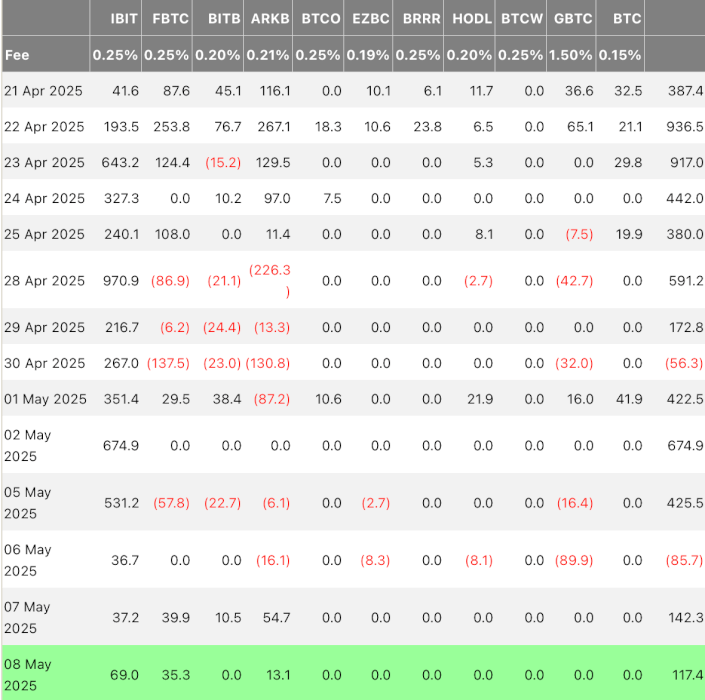

According to the diligent scribes at Farside, the collective pulse of America’s spot Bitcoin ETFs quickened to the tune of $117.4 million in net inflows for the day—slightly less than the previous day’s passionate confession of $142.3 million. Perhaps some, flustered by the newcomer Bitcoin’s immodest stride past the six-figure mark, felt compelled to gather their winnings lest fate remember their existence.

Yet the music played on undiminished. At center stage, BlackRock’s iShares Bitcoin Trust—IBIT to its confidants—twirled gracefully with $69 million in fresh affection, its dance card now boasting a rather immodest $44.3 billion. Fidelity’s own FBTC, not to be outdone, fluttered demurely with $35.3 million, as if to say, “I too hold sway, madam, fear not!”—bringing its grand total to $11.6 billion since it entered this fanciful cotillion.

A Stubborn Refusal to Let Go: ETCs Clutch Their Coins Tight 🤲

Not a single coin slipped through trembling fingers that Thursday. Indeed, one might imagine investors—whether noble of birth or humble retail squire—clasping their ETF slips with the white-knuckled intensity of a lovesick poet rereading his last telegram. The silence of outflows was deafening, and if you listened closely, you might even hear Bitcoin mocking its doubters from afar, punctuating each price tick with a smirk.

It is a testament, perhaps, to the peculiar stage of maturity this ETF masquerade has attained—gone are the days of frantic gambling; now, attendees sip tea and contemplate “long-term exposure” (a phrase that would scandalize any proper salon in Petersburg). The rally continues, the guests refuse to leave, and somewhere in the distance, a banker sobs quietly into a cravat.

Read More

- Invincible’s Strongest Female Characters

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Reach 80,000M in Dead Rails

- Gold Rate Forecast

- USD ILS PREDICTION

- Silver Rate Forecast

2025-05-09 13:06