As a seasoned analyst with over two decades of experience in global financial markets, I have witnessed firsthand the ebb and flow of economic cycles and the transformation of investment landscapes. The latest insights surrounding Bitcoin’s potential growth in 2025 pique my interest, as they resonate with trends I’ve observed throughout my career.

2025 may see a significant influx of liquidity, according to current expert predictions, which could lead to approximately $2 trillion in fresh investments flowing into Bitcoin.

This forecast arises because it’s anticipated that the U.S. Federal Reserve will substantially expand the global money supply. If this happens, Bitcoin’s market value and price may potentially experience a rise.

Liquidity Growth And Bitcoin’s Market Implications

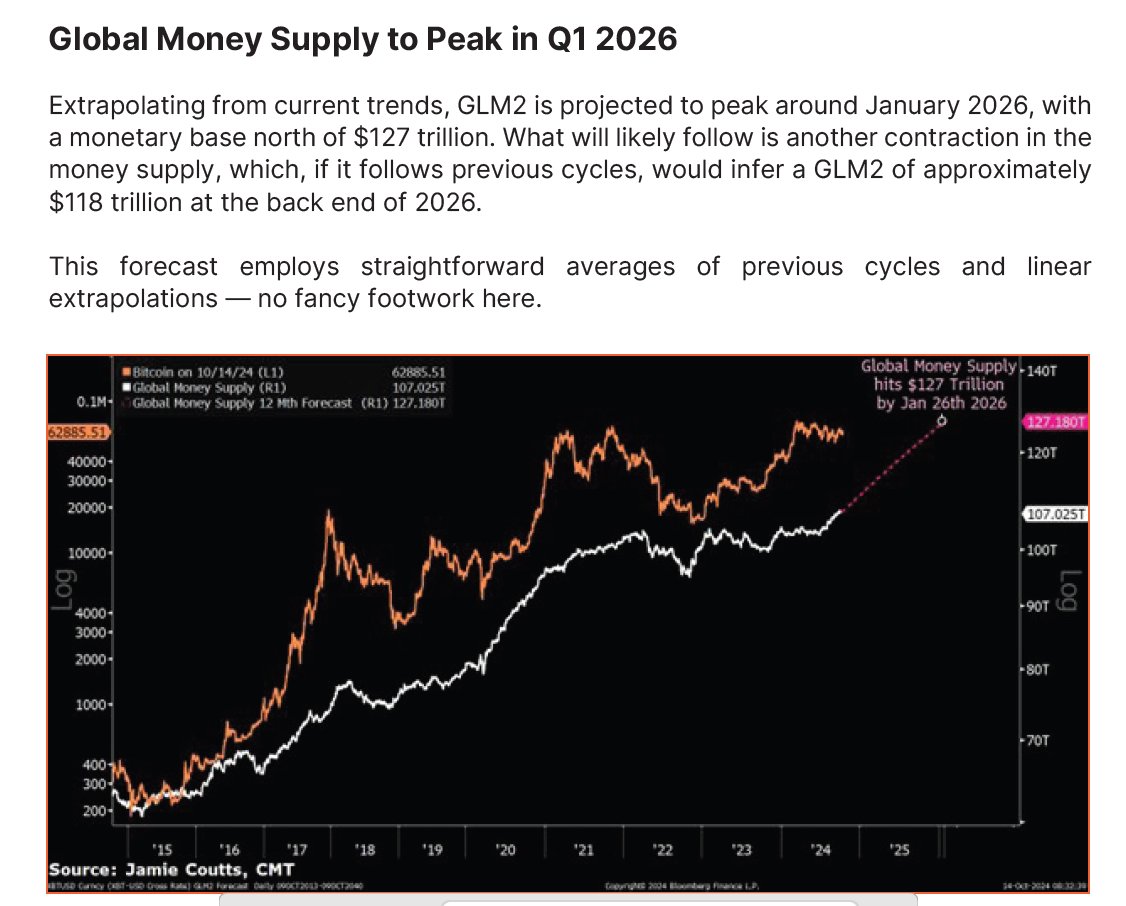

Jamie Coutts, a top crypto analyst at Real Vision, predicts that the worldwide M2 money supply (currently $107 trillion) could reach over $127 trillion by 2025, marking an approximately 18% increase in liquidity. This significant expansion of funds, driven by economic conditions and monetary policies, could potentially serve as a crucial trigger for Bitcoin.

Coutts points out that traditionally, Bitcoin has absorbed roughly 10% of any newly introduced liquidity. This implies that Bitcoin might experience substantial investment during the forthcoming time frame.

Coutts clarified that Bitcoin’s behavior tends to align with shifts in liquidity within the worldwide financial market. Data from the past shows an increase in the global M2 money supply, rising from $94 trillion in Q4 2022 to $105 trillion as of now.

The total M2 money supply worldwide dropped to approximately $94 trillion in Q4 2022 and then rose to $105 trillion. Concurrently, the market capitalization of Bitcoin increased fivefold, bringing an additional $1.5 trillion into the cryptocurrency market. In essence, about 10% of the newly created money has moved from conventional fiat systems into Bitcoin, which is becoming a significant reserve asset alongside gold and equities.

— Jamie Coutts CMT (@Jamie1Coutts) November 28, 2024

Over the identical time frame, Bitcoin’s market value multiplied by five, contributing approximately $1.5 trillion. This suggests that Bitcoin took up around 10% of the fresh liquidity being introduced into the system, further solidifying its position as a potential future global reserve asset.

By the estimated $20 trillion increase in liquidity by 2025, there’s a possibility that Bitcoin could draw in around $2 trillion in fresh investments. The analysis from Coutts indicates that factors such as monetary devaluation and Bitcoin’s impressive annual returns over 113% may foster increased institutional adoption of the cryptocurrency.

This development makes Bitcoin appear more and more appealing as a replacement for conventional investments, especially given ongoing worries about the durability of fiat currencies.

Bitcoin’s 2025 Prospects and Institutional Adoption

According to Coutts’ forecast, the worldwide M2 money supply is expected to reach its highest point on January 26, 2026, due to ongoing economic policies that are increasing monetary reserves.

According to predictions, the Bitcoin price could rise to $150,000 by 2025. This increase may occur as a result of diminishing trust in the U.S. dollar and the overall fiat currency system, leading investors to explore other options for safeguarding their wealth.

As an analyst, I find it plausible that institutional interest in Bitcoin (BTC) will increase due to its demonstrated resilience and profitability. Given its growing reputation as a potential hedge against inflation and monetary debasement, Bitcoin could draw in a broader range of investors searching for stability amidst economic turmoil.

Featured image created with DALL-E, Chart from TradingView

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- POL PREDICTION. POL cryptocurrency

- Brent Oil Forecast

- EUR CNY PREDICTION

- HBOs The Last of Us Used Heavy Make-up To Cover One Characters Real-Life Injury

- EUR ZAR PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- EUR AUD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2024-11-30 10:41