As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless market fluctuations and whale activities that can significantly impact the trajectory of assets. The recent accumulation of Bitcoin by three new wallets, as reported by Lookonchain, is a development that warrants close attention.

According to reports from Lookonchain, there has been a significant surge in Bitcoin (BTC) after a substantial market decline last week. Starting on September 1st, three notable entities within the cryptocurrency industry collectively acquired an impressive 2,814 BTC, which is the equivalent of approximately $157.3 million.

They withdrew these funds from Binance, with an average Bitcoin purchase price of around $55,887, a move that’s piqued interest among market observers, especially considering the swiftness and strategic timing of these acquisitions.

It’s intriguing to note that these three wallets identified as “bc1qg,” “bc1qd,” and “36LMb” have been active for approximately a week. At present, they collectively hold 2,814 Bitcoins, with the breakdown being 1,381 BTC, 433 BTC, and 1,000 BTC respectively. The wallet with the highest balance, “bc1qg,” holds approximately $76.28 million worth of Bitcoin. The other two wallets hold around $23.92 million (in “bc1qd”) and $55.24 million (in “36LMb”).

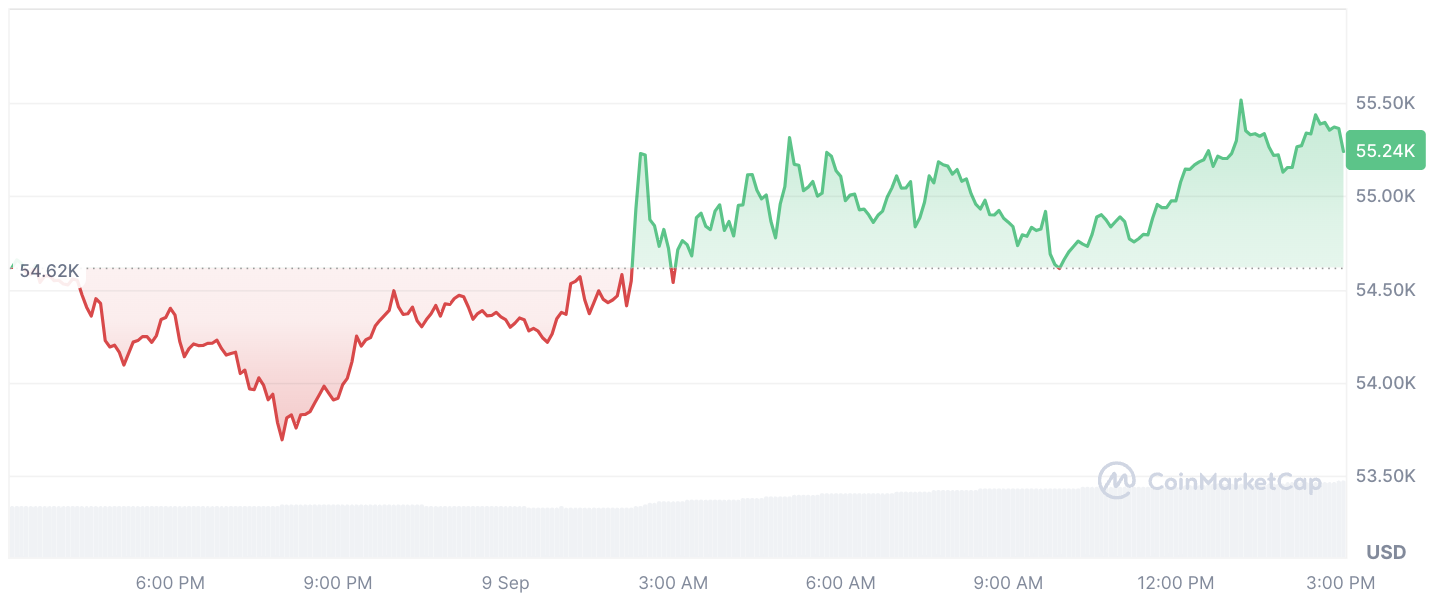

What makes this even more interesting is what is going on behind the scenes. Bitcoin had dropped 12% from its weekly high, falling to $52,550, which had a knock-on effect on the whole cryptocurrency market. This resulted in a nearly 4% contraction in overall market capitalization, which equates to about $73 billion lost.

What’s next?

Despite the pessimism, the market narrative shifted as Bitcoin rebounded slightly to $55,350 just days after the decline. This makes one wonder: is this just a short-lived “dead cat bounce,” or could it be the first sign of a renewed bull market, given these significant whale purchases?

Despite the ongoing uncertainties, it’s prudent to monitor the activities of these emerging crypto wallets. These entities have been making significant investments in the market, even when its performance is less than ideal. This suggests that some influential figures are confident enough to invest in Bitcoin‘s durability – at least momentarily.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- Top gainers and losers

- ENA PREDICTION. ENA cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

2024-09-09 14:33