As an analyst with over two decades of experience in the financial markets, I must admit that the recent surge in investments into XRP-focused ETFs has caught my attention. With a staggering inflow of $15.2 million last week, it’s hard not to be intrigued by this digital asset’s potential.

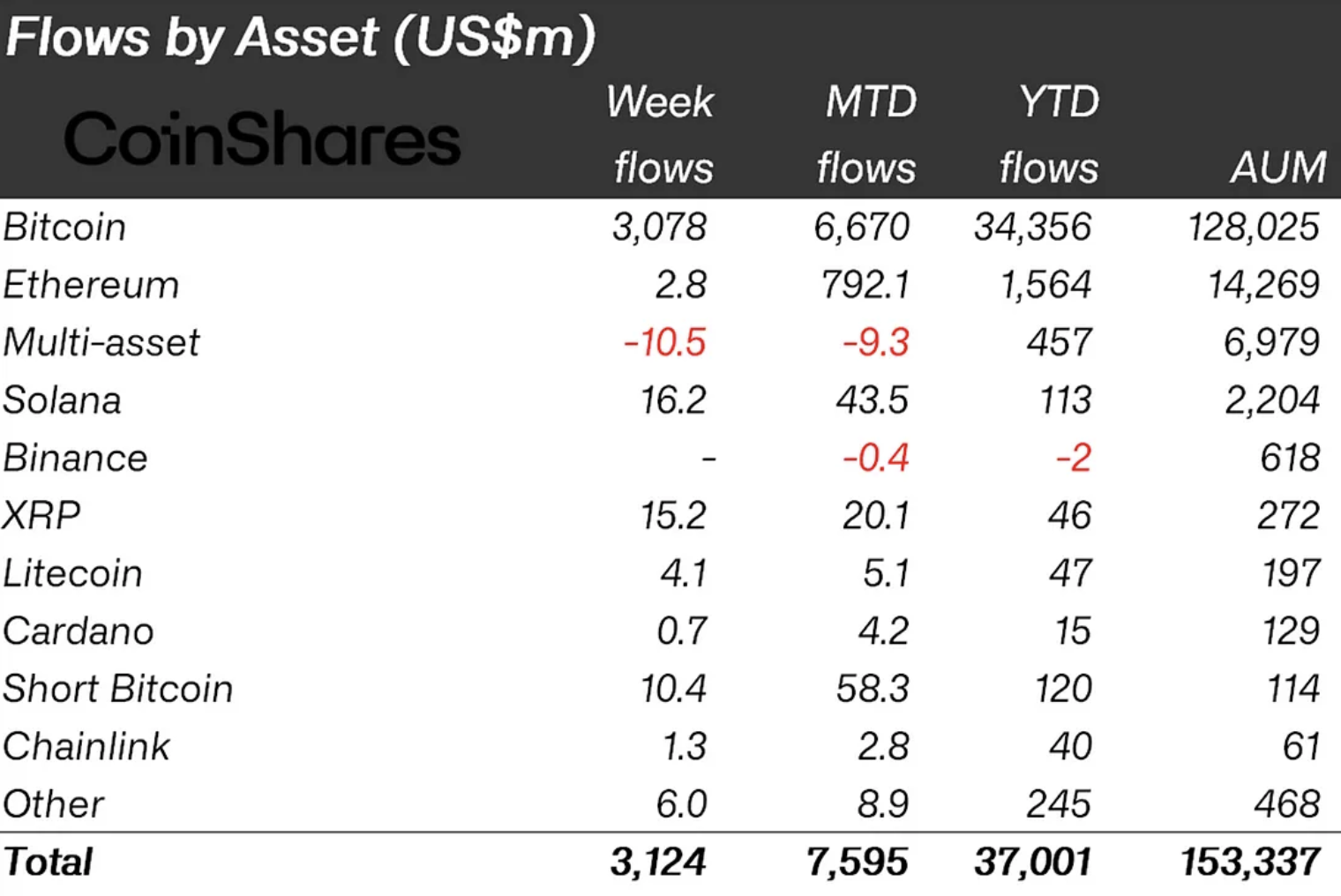

According to recent weekly research by CoinShares, there was a significant surge in investments tied to popular cryptocurrency, with inflows reaching an impressive $15.2 million. This figure represents a 353% increase compared to the previous week and brings the total year-to-date for XRP-focused ETFs to $46 million.

To put it another way, the amount of funds flowing into XRP ETPs last week was nearly half compared to the previous 11 months combined, according to basic calculations. This surge in funds can be attributed to the significant price movement of the well-known cryptocurrency, XRP. The factors that caused the price of XRP to skyrocket over 222% at its peak are the same ones that spurred traders of ETPs (Exchange Traded Products) to invest in XRP last week.

Beyond the news of Gensler stepping down as SEC chairman, a potential factor driving the rise in both cryptocurrency and traditional markets might be the anticipated Initial Public Offering (IPO) of Ripple, a San Francisco-based firm that incorporates XRP into its enterprise blockchain services and solutions.

Ripple IPO

About a week ago, the head of SBI, a significant Japanese financial group, hinted that Ripple might go public soon because of imminent changes in U.S. regulations. Notably, prior to this announcement, the company was estimated to be worth approximately $30 billion. However, currently, there is around $55 billion worth of XRP held within their escrow accounts. Although some of it is being withdrawn, a considerable amount remains.

Should Ripple successfully launch as a public company, having navigated three years of legal battles with the SEC over XRP’s classification, this could significantly boost the cryptocurrency, its usage, and recognition. Few other digital assets possess similar utility, widespread adoption, and regulatory standing supported by U.S. court decisions.

Read More

- Top 5 Swords in Kingdom Come Deliverance 2

- Best Avowed Mage Build

- How to Use Keys in A Game About Digging A Hole

- Reverse: 1999 – Don’t Miss These Rare Character Banners and Future Upcoming Updates!

- Brent Oil Forecast

- OKB PREDICTION. OKB cryptocurrency

- EUR AUD PREDICTION

- 8 Best Souls-Like Games With Co-op

- Captain America: Brave New World Director Addresses The Film’s Biggest Loss

- LUNC PREDICTION. LUNC cryptocurrency

2024-11-25 18:59