In the bleak landscape of the U.S. stock market, where tariffs reign supreme and equities tremble with fear, a lone wolf emerges, relatively unscathed. Bitcoin, the oft-maligned cryptocurrency, stands tall, a monument to the capricious nature of fate. Joe Burnett, Director of Market Research at Unchained, offers his insights into this peculiar phenomenon, a wry smile no doubt spreading across his face as he utters the words.

Meanwhile, in the trenches of Wall Street, the cries of despair echo through the canyons of steel and stone. U.S. stocks, those erstwhile titans of commerce, now lie battered and bruised, their worst performance in years a grim testament to the times. And yet, amidst this maelstrom, Bitcoin stirs, its resilience a beacon of hope for institutional investors seeking refuge from the tempests of traditional finance.

Trump’s tariffs are here, U.S. equities are crashing, and China is retaliating… 🌪️

Now may be one of the best times to build a meaningful bitcoin position. 🤑

Not financial advice, of course! 😉

— Joe Burnett, MSBA (@IIICapital) April 4, 2025

The numbers, cold and unforgiving as the Soviet winter, tell a tale of woe: over 2,200 points shed by the Dow Jones Industrial Average on April 4, preceded by a 1,679-point decline on Thursday. The worst two-day performance in history, a dubious distinction that has left equity investors quaking in their boots.

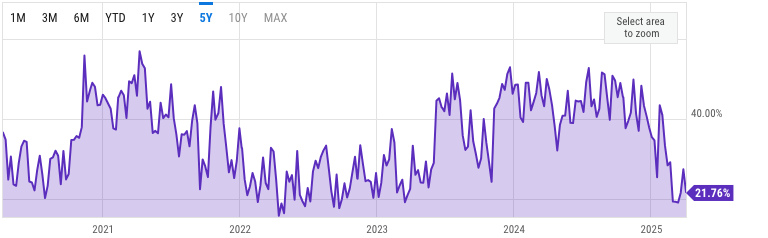

And Bitcoin, that mercurial entity? A 2.2% gain in the last 24 hours, a gentle uptick that belies the turmoil surrounding it. Burnett, ever the sage, detects a pattern, a ghostly echo of 2020, when Bitcoin prices led the market recovery like a will-o’-the-wisp guiding lost travelers through treacherous terrain.

Recalling March 2020, bitcoin rapidly bottomed and recovered first (before U.S. equities), a pattern potentially repeating today as bitcoin hasn’t made new lows since March 11th… 🕰️

But why, oh why, does Bitcoin exhibit this contrarian streak? Burnett’s explanation is laced with a hint of dark humor: it’s often the first asset to be cast into the outer darkness when liquidity dries up, only to rebound with a vengeance, like a phoenix from the ashes. This volatility, a double-edged sword, may yet prove to be Bitcoin’s salvation – or its undoing.

And what of the stocks, those fallen titans? Are they, too, nearing a bottom, like a penitent seeking absolution? The AAII investor sentiment survey, that venerable gauge of market mood, plunged to 19.11% on March 13, a nadir not seen since the pandemic’s dark days. Perhaps, just perhaps, this extreme negative outlook heralds a reversal, a turning of the tide.

Yet, Burnett’s parting shot is a sobering one, a reminder that in this treacherous landscape, no asset is entirely safe from the slings and arrows of outrageous fortune.

Of course, if stocks continue falling aggressively over the coming weeks, it’s reasonable to expect that bitcoin could experience another leg down too… 😬

Read More

- Invincible’s Strongest Female Characters

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Top 8 UFC 5 Perks Every Fighter Should Use

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- Gold Rate Forecast

- How to Reach 80,000M in Dead Rails

- Silver Rate Forecast

- USD ILS PREDICTION

2025-04-04 23:12